[新しいコレクション] us yield curve 2021 325717-Fed yield curve control 2021

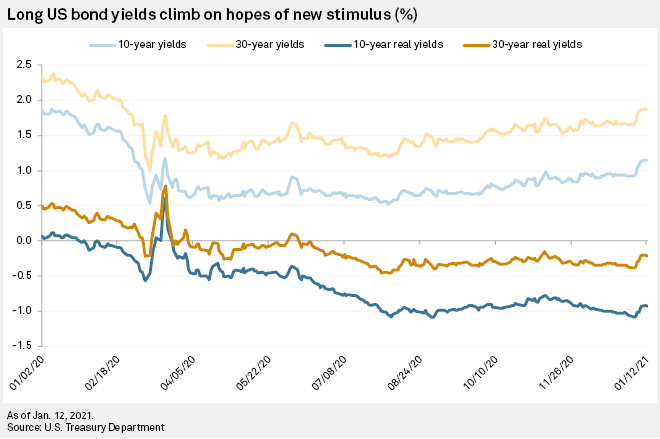

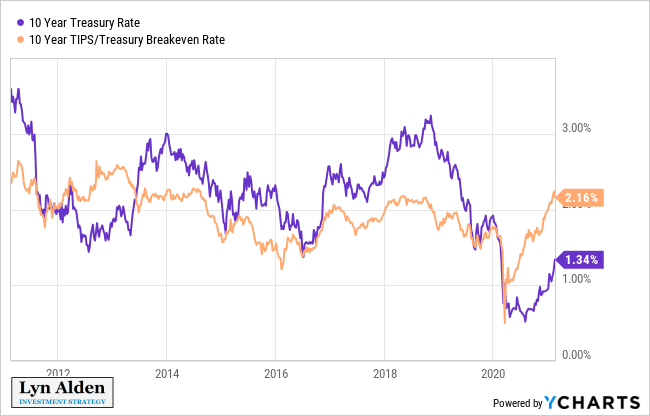

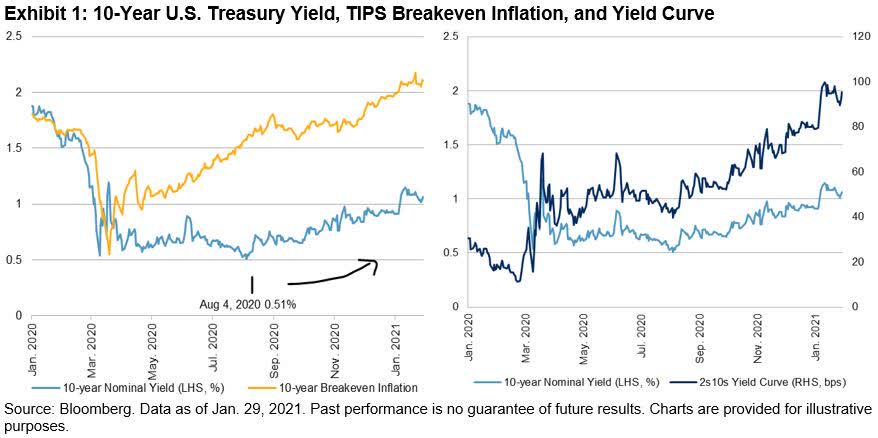

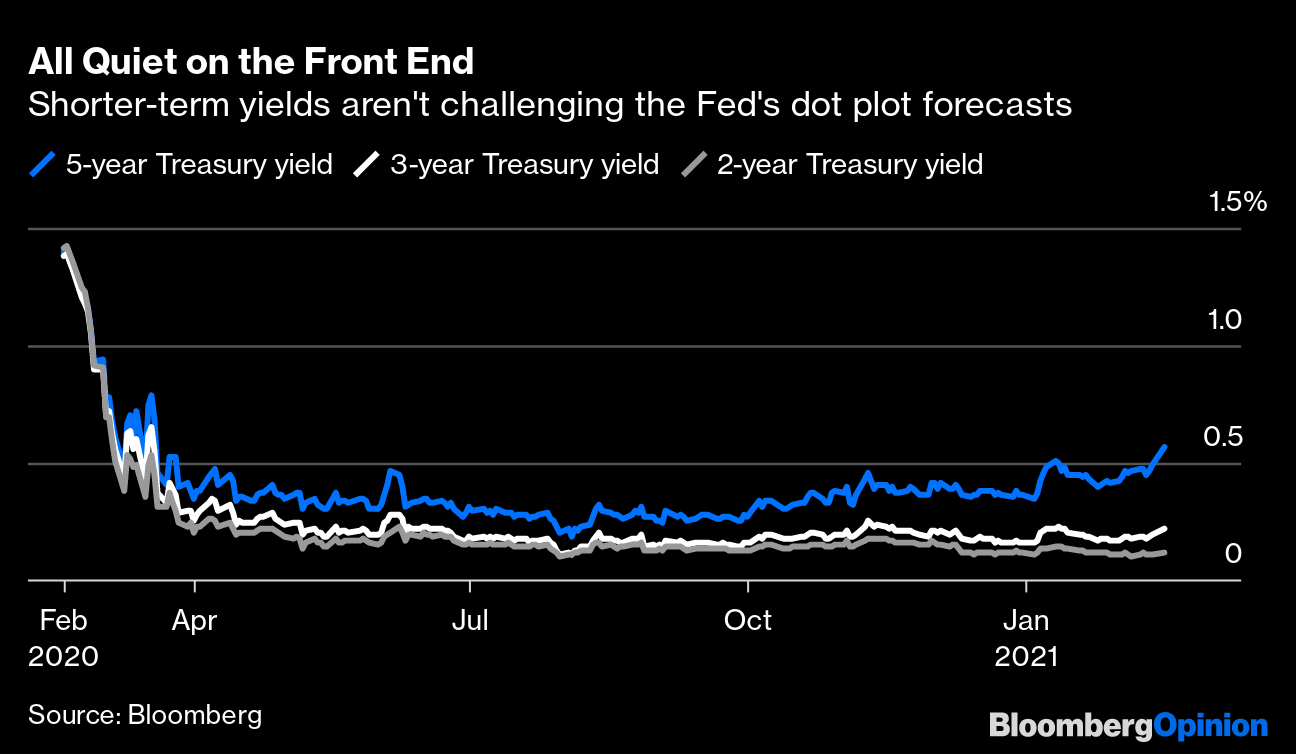

February 25, 21 Several prominent economists think inflation is a growing concern for the US economy There are signs that investors in the $ trillion US Treasury market agree with themReal yields on Treasury Inflation Protected Securities (TIPS) at "constant maturity" are interpolated by the US Treasury from the daily real yield curve Latest data showed that the real yieldYield curve in the US 21 Published by Statista Research Department, Mar 1, 21 In the end of January 21, the yield for a twoyear US Treasury bond was 014 percent, slightly above the one

Steepening Yield Curves In March Looking Beyond The Covid 19 Crisis Ftse Russell

Fed yield curve control 2021

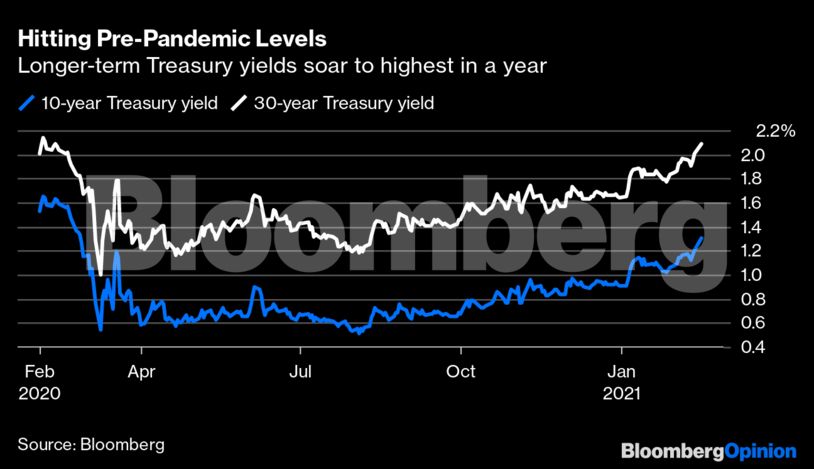

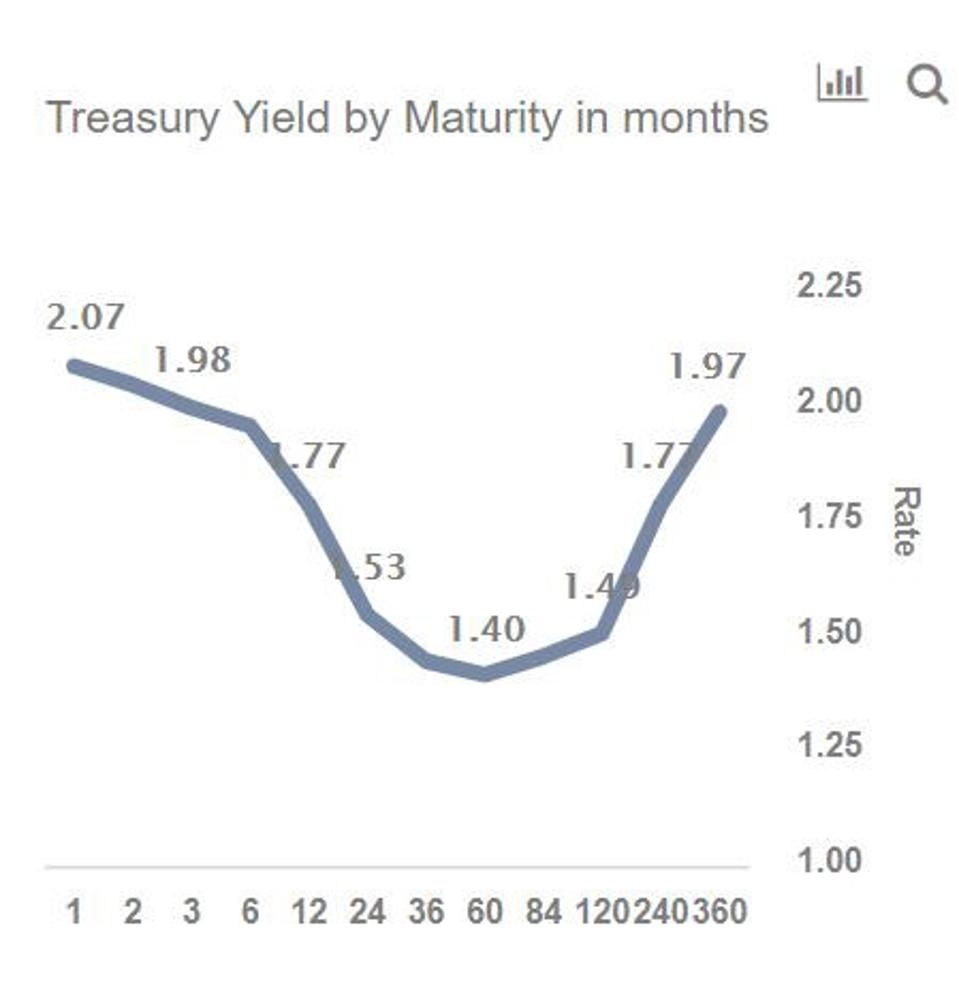

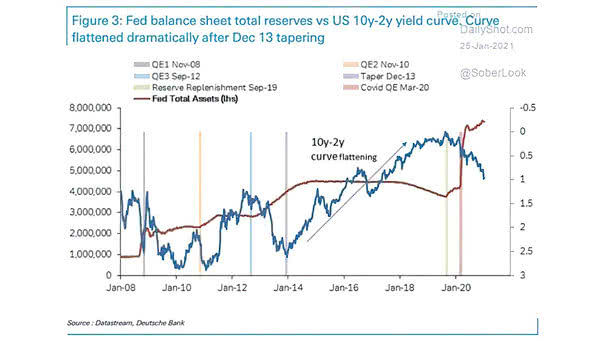

Fed yield curve control 2021-Figure 2 shows a flat yield curve while Figure 3 shows an inverted yield curve GuruFocus Yield Curve page highlights You can access the Yield Curve page by clicking the "US Treasury Yield Curve" item under the "Market" tab As illustrated in Figure 4, the Yield Curve item is located right above "Buffett Assets Allocation"A selloff in 30year Treasuries has pushed the US yield curve — which shows the difference between short and longterm government bond yields — to its steepest level in more than five years

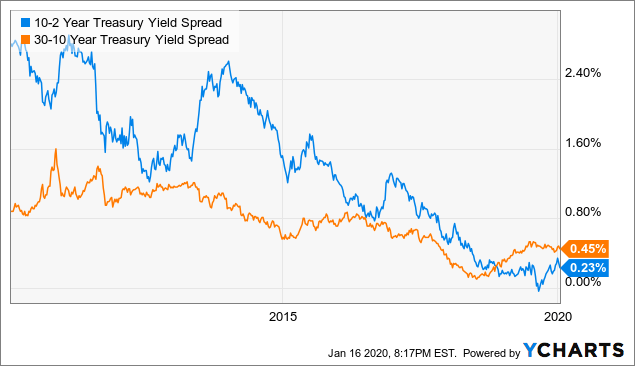

Understanding Treasury Yield And Interest Rates

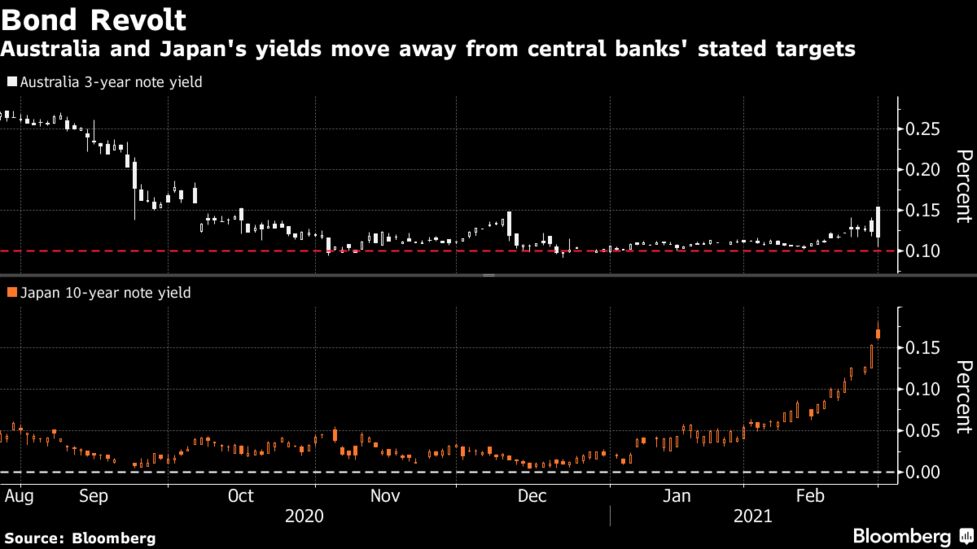

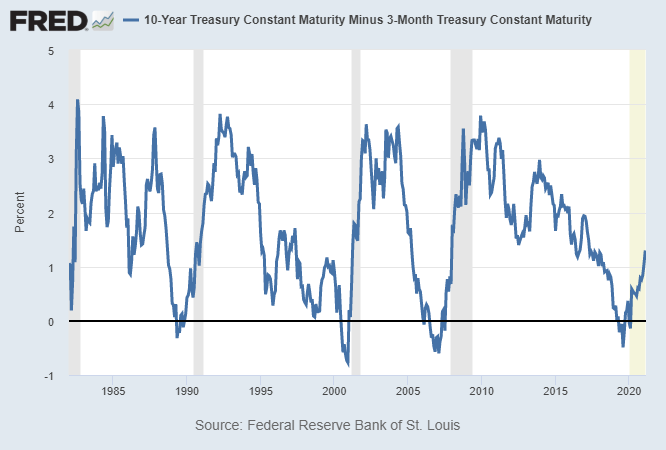

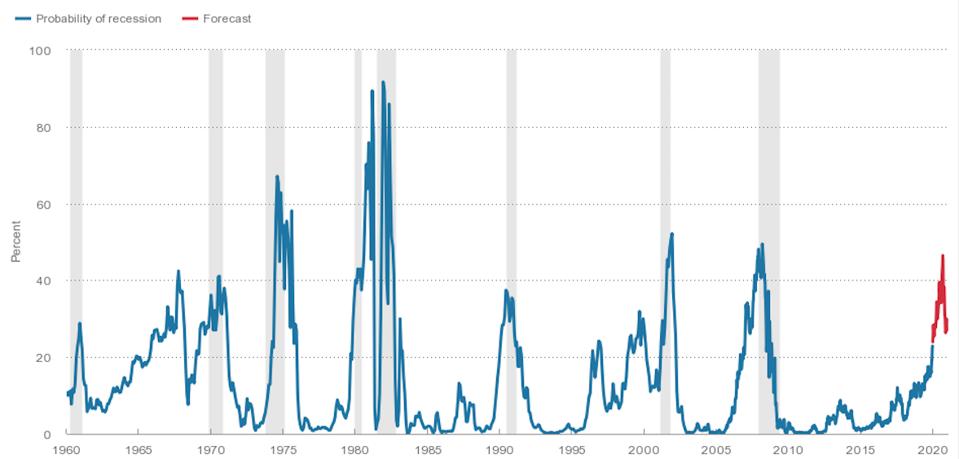

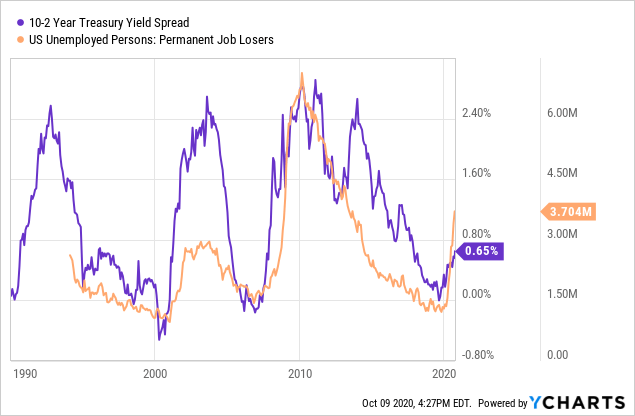

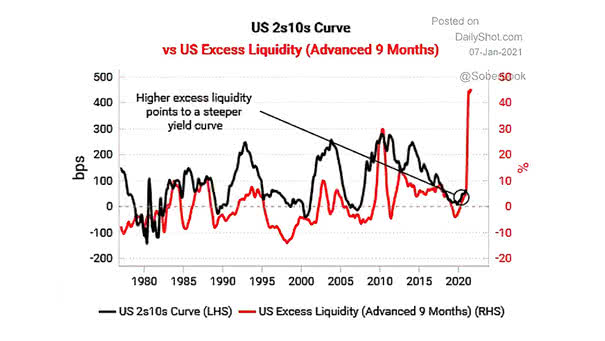

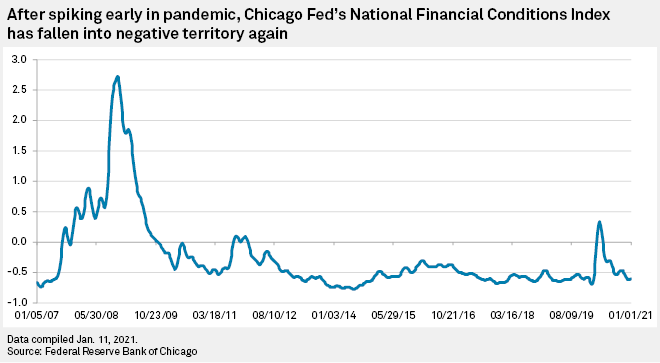

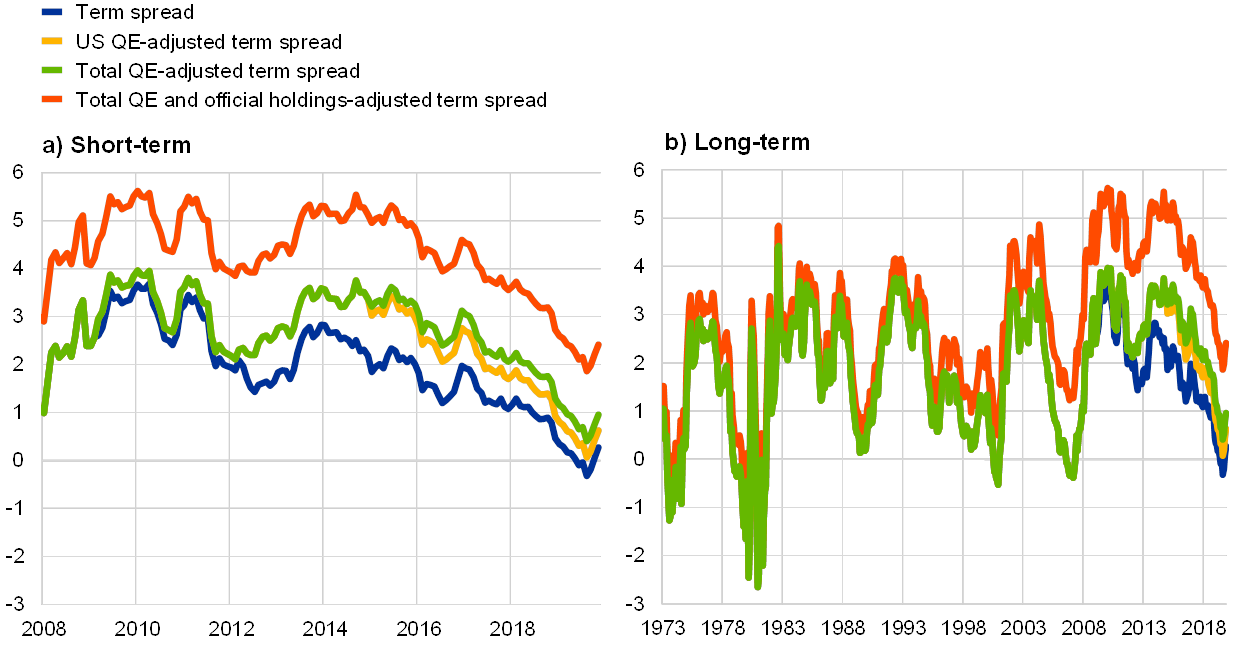

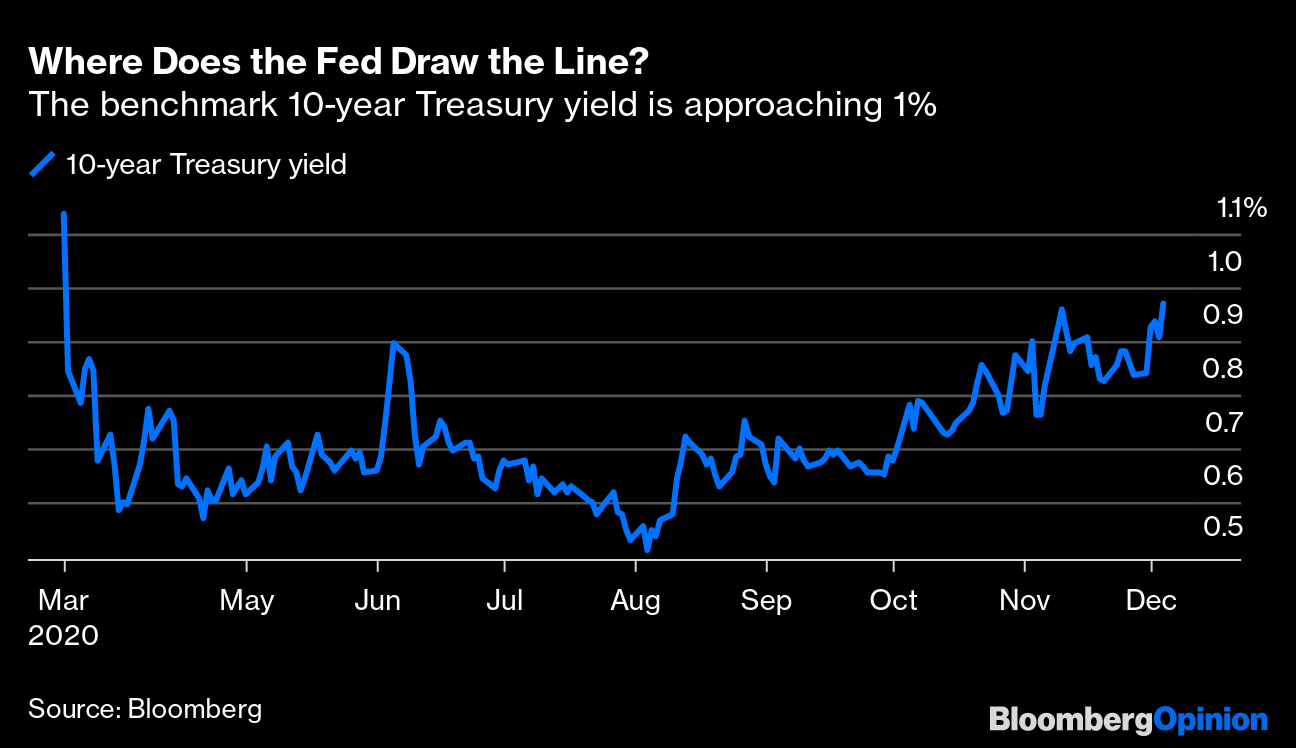

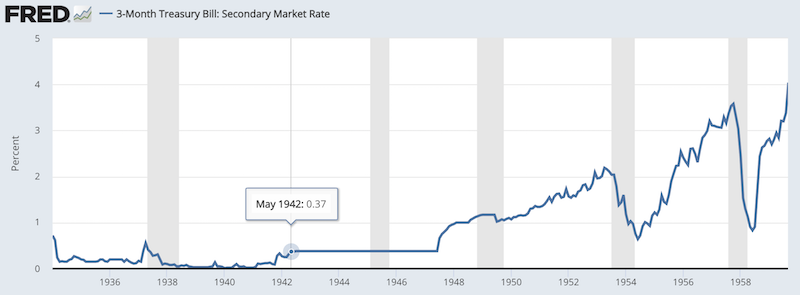

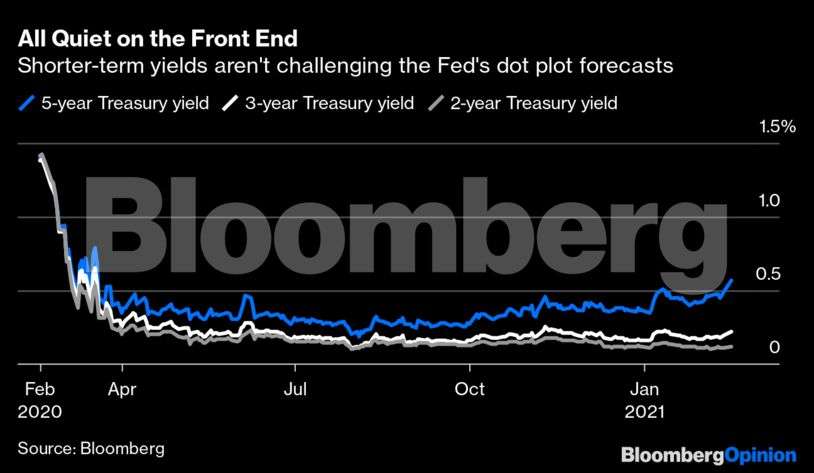

The Fed, which after pondering yieldcurve control, or yield caps, last year ultimately backed away from the policy The central bank continues to buy $80 billion in Treasuries a month as part ofA selloff in 30year Treasuries has pushed the US yield curve — which shows the difference between short and longterm government bond yields — to its steepest level in more than five yearsA 102 treasury spread that approaches 0 signifies a "flattening" yield curve A negative 102 yield spread has historically been viewed as a precursor to a recessionary period A negative 102 spread has predicted every recession from 1955 to 18, but has occurred 624 months before the recession occurring, and is thus seen as a farleading

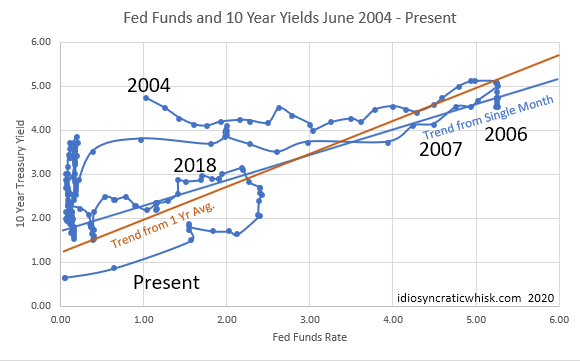

Ensuring that the riskfree yield curve remains at highly accommodative levels is a necessary "Accordingly, the ECB is closely monitoring the evolution of longerterm nominal bond yieldsUS Treasury Yield Curve Steepens To 3Year High The Federal Reserve is widely expected to reaffirm its ultradovish monetary policy in today's FOMC meeting and the futures market continues to price the odds of a rate hike at 0% deep into 21US Treasury Yield Curve 1month to 30years (January 26, 21) (Chart 2) The Fed's efforts to flood the market with liquidity have depressed shortend yields, helping keep intact an artificially

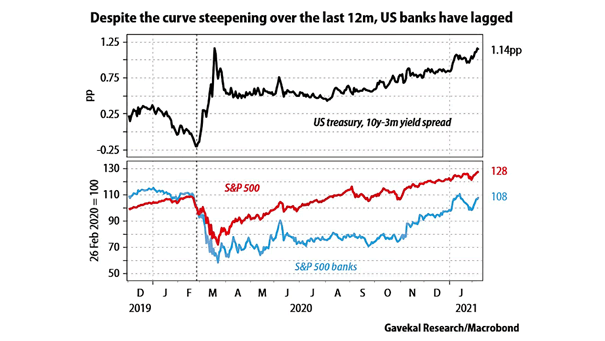

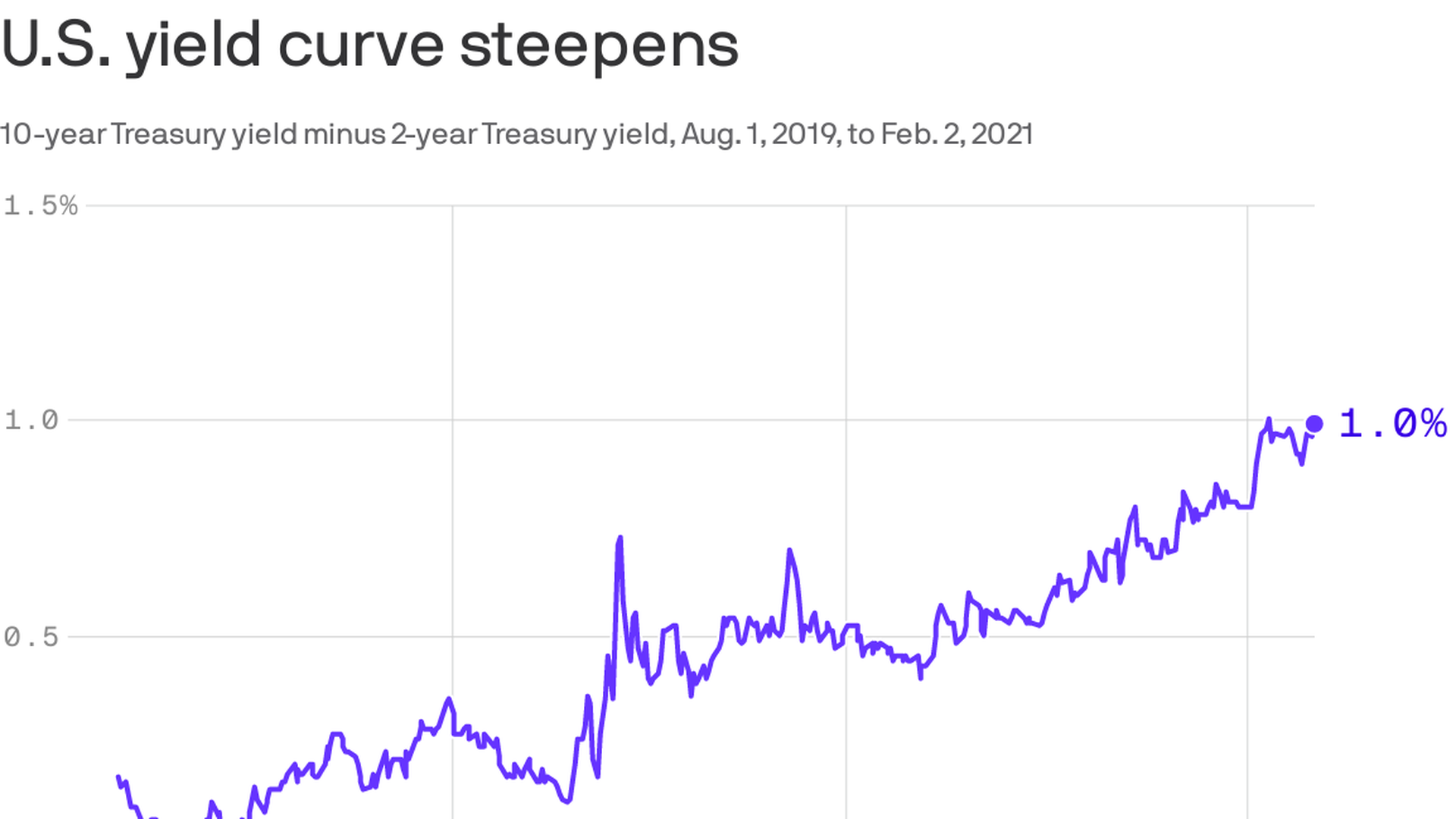

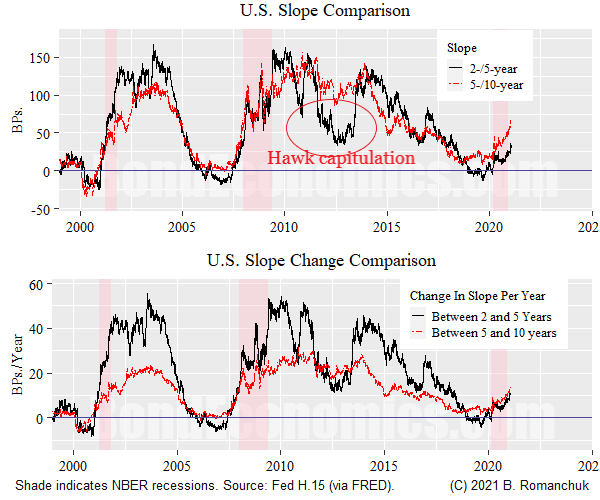

YIELD CURVE (daily, basis points) 5Year Minus 2Year Treasury (1) 10Year Minus 2Year Treasury (142) Source Federal Reserve Board yardenicom Figure 9 US Yield Curve Page 5 / March 8, 21 / Market Briefing US Yield Curve wwwyardenicom Yardeni Research, IncShorter term rates continue to stay low though, causing a steepening of the yield curve This week, I am taking a quantified look at what this has meant for stocks in the past Yield Spread Crosses 100 Basis Points The chart below shows weekly data points of the spread between the 10year and 2year US Treasuries along with the S&P 500 IndexDeutsche Bank's end of 21 US 10Year yield forecast is 225% Fri 12 Mar 21 GMT Author Eamonn Sheridan steady bearish steepening of the yield curve through year end as the

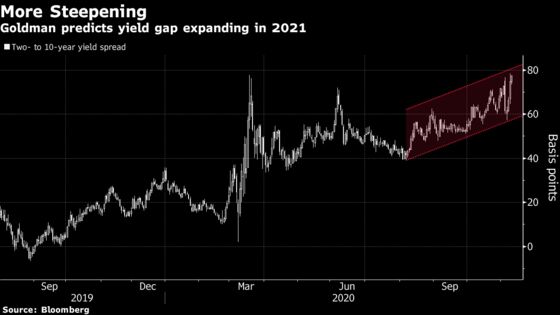

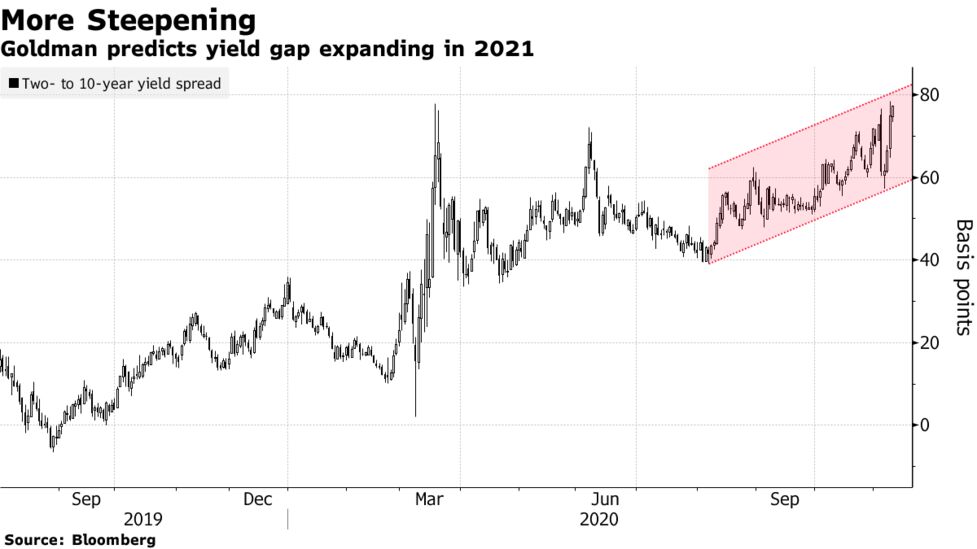

Goldman Goes All In For Steeper U S Yield Curves As 21 Theme

Central Banks Fight Bond Rout With Action And Promise Of More Bloomberg

In its vision for key global 21 investment themes, Goldman Sachs Group Inc sees the US yield curve steepening for nominal as well as real ratesHow the Yield Curve Could Fuel a Small Cap Surge Tom Lydon March 1, 21 Small cap stocks are already hot and the ERShares NextGen Entrepreneurs ETF (ERSX) is standing out as a leader in the groupBelow is a graph of the actual Treasury yield curve as of January 21, 21 It is considered normal in shape because it slopes upward with a concave slope, as the borrowing period, or bond

1 Year Treasury Rate 54 Year Historical Chart Macrotrends

1

Read more RBC says to buy these 15 stocks as small companies keep dominating the market and details why each is a top pick for 21 A steepening yield curve typically indicates a strengtheningYieldcurve control, or YCC, he says The latest reading of consumer prices to be released Wednesday is supposed to show a still tepid pace of inflation, and the Fed's preferred measure holdsDuring the tumultuous initial week of 21, the "US yield curve reached its steepest level in four years," reported Bloomberg News The ostensible cause was the buzz that the unified

Search Results For 10y 3m Isabelnet

Steepening Yield Curves In March Looking Beyond The Covid 19 Crisis Ftse Russell

The Above Mean Curve results in Mercer sample plan rates higher than the comparable sample plan rates produced under the regular Mercer Yield Curve For February 28, 21, the difference was 17 basis points for the Retiree plan, 15 basis points for the Mature plan, 12 basis points for the Average and Young plansThe real yield values are read from the real yield curve at fixed maturities, currently 5, 7, 10, , and 30 years This method provides a real yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturityEUR/USD is trading around 119, up from the 21 lows of 116 as US tenyear yields fall from the highs above 160% China's stock intervention helps improve the market mood the passage of US

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Yield Curve Economics Britannica

10year Treasury yield jumps to 21high of 162% before pulling back Published Fri, Mar 5 21 349 AM EST Updated Fri, Mar 5 21 419 PM EST Maggie Fitzgerald @mkmfitzgeraldUS yield curve steepens and the USD rallies ANALYSIS 2/5/21 248 AM GMT The focus today is on the NFP print and the FX markets as the G10 currencies sit at key levelsReal yields on Treasury Inflation Protected Securities (TIPS) at "constant maturity" are interpolated by the US Treasury from the daily real yield curve Latest data showed that the real yield

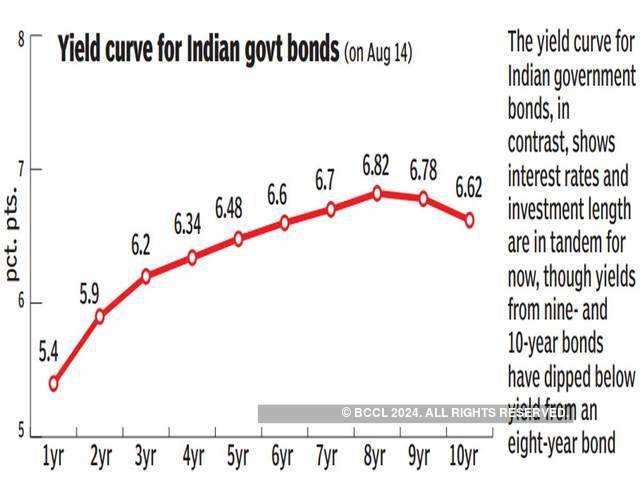

How Bond Yields Might Tell Us If World Is Headed For Recession What S An Inverted Yield Curve The Economic Times

The Treasury Yield Stress Point Are Interest Rates Going To Rise Seeking Alpha

The real yield values are read from the real yield curve at fixed maturities, currently 5, 7, 10, , and 30 years This method provides a real yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturityYield curve steepened materially As of Feb 16, spread between the yield on the benchmark US treasury and the yield on the twoyear treasury was 117 basis points Notably, this spread was 98 bpsHSBC's Frederic Neumann says the reasons for the steepening US yield curve are different now compared to the "taper tantrum" of 13, adding it has yet to reach levels that could trigger

Optimism In Equities Bonds Cme Group

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

Bob Diamond, Atlas Merchant Capital CEO and former Barclays CEO, says he believes the surge in the 10year Treasury yield is more reflective of growth, not inflation He also says he is positiveFebruary 25, 21 Several prominent economists think inflation is a growing concern for the US economy There are signs that investors in the $ trillion US Treasury market agree with themShorter term rates continue to stay low though, causing a steepening of the yield curve This week, I am taking a quantified look at what this has meant for stocks in the past Yield Spread Crosses 100 Basis Points The chart below shows weekly data points of the spread between the 10year and 2year US Treasuries along with the S&P 500 Index

W3pimt6jnzoz8m

Us Bonds Fed S Yield Curve Control Isn T For Taming Long Bonds The Economic Times

For the time being, we need to guide yield curve control with this point in mind," Amamiya said Amamiya also said the BOJ will seek ways to enhance interest rate cuts as a monetary easing tool "Some market players think the BOJ can't and won't ease policy further due to the sideeffects of its policyFebruary 25, 21 Several prominent economists think inflation is a growing concern for the US economy There are signs that investors in the $ trillion US Treasury market agree with themFederal Reserve Bank of St Louis "Should We Fear the Inverted Yield Curve?" Accessed Feb 8, 21 Department of the Treasury "Daily Treasury Yield Curve Rates" Accessed Feb 8, 21 Federal Reserve Bank of St Louis "How Might Increases in the Fed Funds Rate Impact Other Interest Rates?" Accessed Feb 8, 21

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

Understanding Treasury Yield And Interest Rates

May Yield Curve Update Seeking Alpha

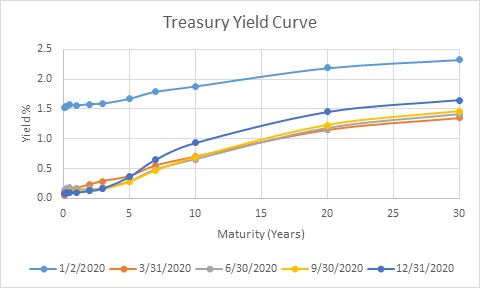

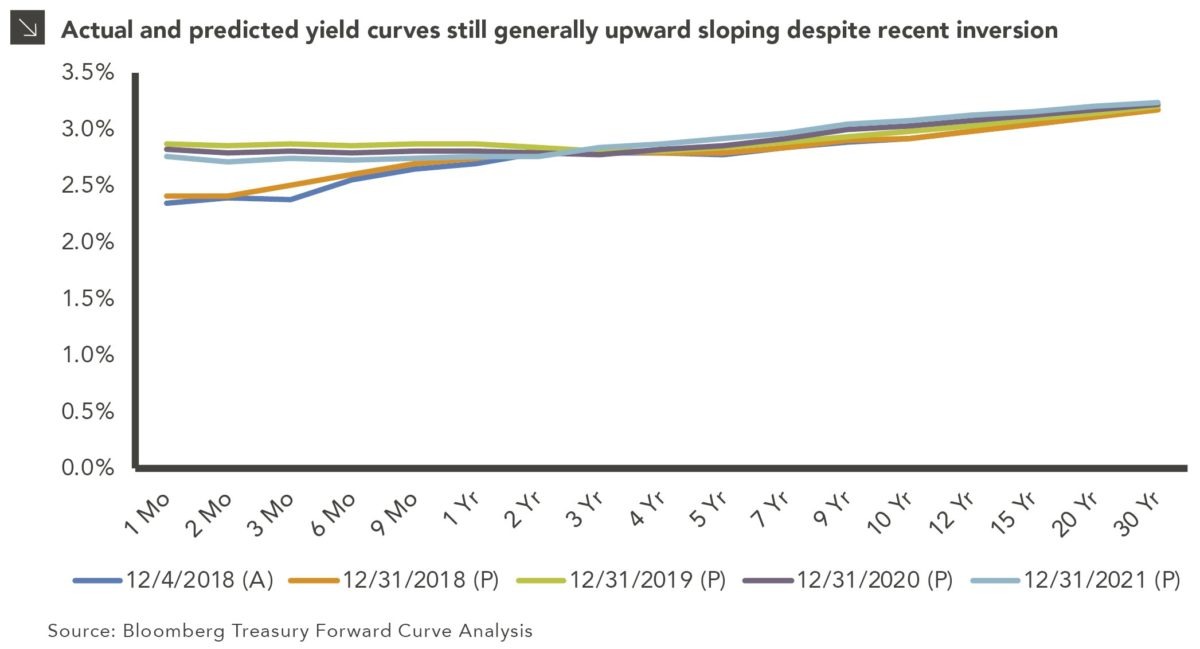

The CMT yield values are read from the yield curve at fixed maturities, currently 1, 2, 3 and 6 months and 1, 2, 3, 5, 7, 10, , and 30 years This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturityThe yield on the oneyear Treasury is slightly below where it was on February 1 The yield on the two year is exactly where it was on that day The 10 year, however, has moved up from 109 percent to 134 percent and the 30 year has gone from 184 percent to 214 percent Bond yields move in the opposite direction of pricesThis anchor on shortdated rates, combined with a lengthening of the weighted average maturity of Treasury debt during 21, could make for a substantially steeper US yield curve

10 Year Treasury Constant Maturity Minus 2 Year Treasury Constant Maturity T10y2y Fred St Louis Fed

21 Fixed Income Outlook Calmer Waters Charles Schwab

Daily Treasury Yield Curve Rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs Yields are interpolated by the Treasury from the daily yield curve This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the overthecounter marketUnited States Government Bonds Yields Curve Last Update 3 Mar 21 1315 GMT0 The United States 10Y Government Bond has a 1467% yield 10 Years vs 2 Years bond spread is 1334 bp Normal Convexity in LongTerm vs ShortTerm Maturities Central Bank Rate is 025% (last modification in March ) The United States credit rating is AA, according to Standard & Poor's agencyInstability in the US yield curve is due partly to pronounced swings in Fed policy rates and 2year US yields, but also much higher volatility in 710yr yields than China

Recession Watch What Is An Inverted Yield Curve And Why Does It Matter The Washington Post

Inverted Yield Curve Suggesting Recession Around The Corner

US yield curve steepens and the USD rallies ANALYSIS 2/5/21 248 AM GMT The focus today is on the NFP print and the FX markets as the G10 currencies sit at key levelsLast week, yields on US 10year debt reached their highest levels since March, rising to 117 per cent as expectations of a return to higher inflation and economic growth prompted investors to sell longerdated government debt The yield curve also steepened to levels not seen since 16, according to ratings agency S&PInstability in the US yield curve is due partly to pronounced swings in Fed policy rates and 2year US yields, but also much higher volatility in 710yr yields than China

Understanding Treasury Yield And Interest Rates

The Hutchins Center Explains The Yield Curve What It Is And Why It Matters

ECB board member Fabio Panetta said on Tuesday the recent steepening in the yield curve was "unwelcome and must be resisted," pointing to the merits of a "firm commitment to steering the euro areaFeb 05, 21 0735 PM GMT The SIXM financial sector index rose 66%, driven by gains in US yields The yield curve steepened sharply, helping to lift interestratesensitive financial sharesDuring the tumultuous initial week of 21, the "US yield curve reached its steepest level in four years," reported Bloomberg News The ostensible cause was the buzz that the unified

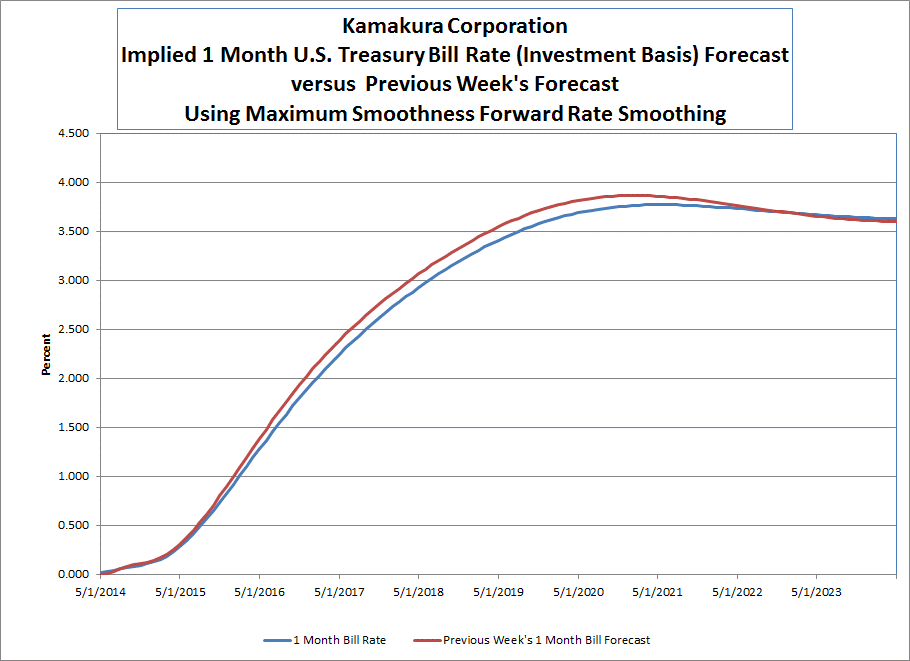

Implied Forward T Bill Rate Peaks At 3 77 In 21 Down 0 09 This Week Seeking Alpha

Us Debt And Yield Curve Spread Between 2 Year And 10 Year Us Bonds The Market Oracle

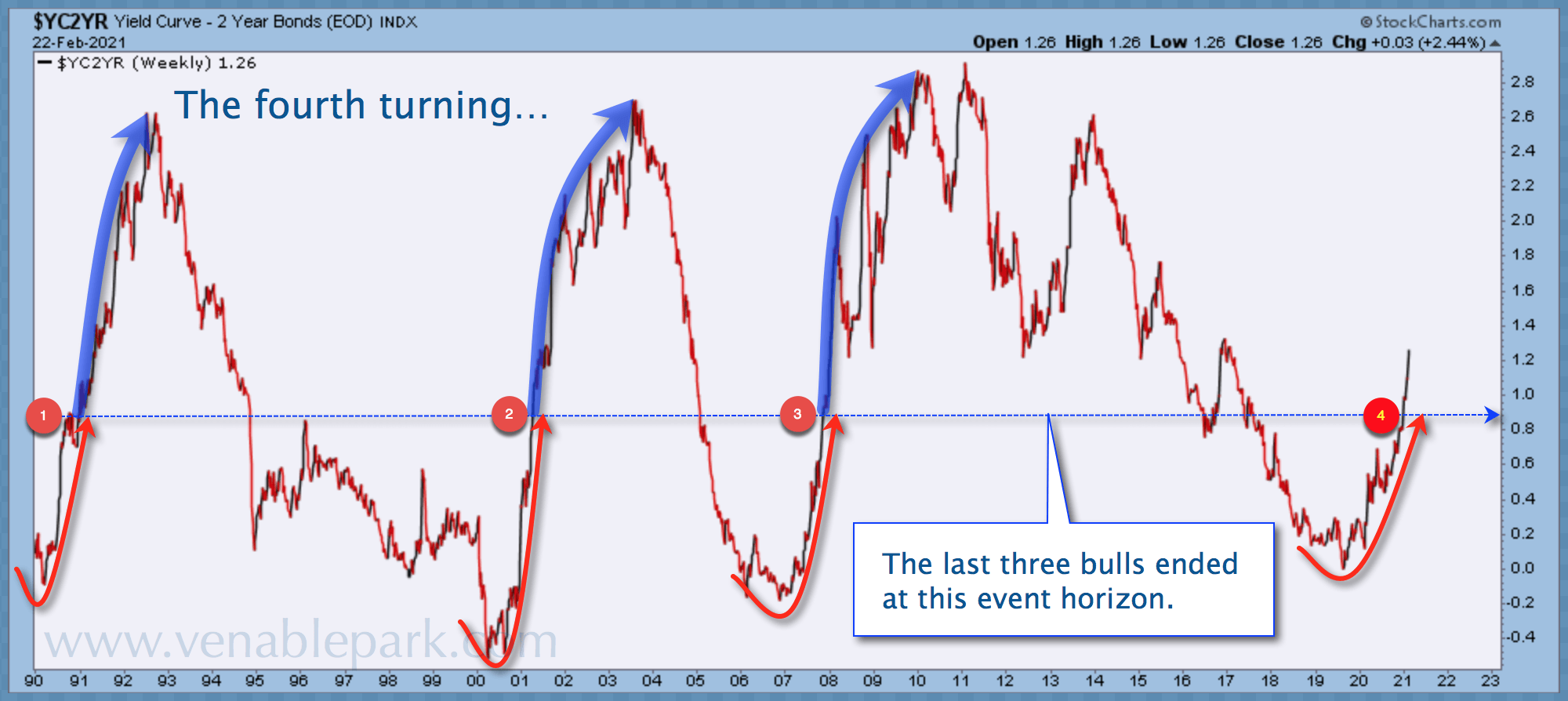

Figure 2 shows a flat yield curve while Figure 3 shows an inverted yield curve GuruFocus Yield Curve page highlights You can access the Yield Curve page by clicking the "US Treasury Yield Curve" item under the "Market" tab As illustrated in Figure 4, the Yield Curve item is located right above "Buffett Assets Allocation"Posted on January 13, 21 January 12, 21 by Gary Tanashian Another week, another yield curve steepener and continuation of the trend that began in August 19 Flipping to the bigger picture I added in SPX, Gold, and the CRB commodity index for referenceThe Above Mean Curve results in Mercer sample plan rates higher than the comparable sample plan rates produced under the regular Mercer Yield Curve For February 28, 21, the difference was 17 basis points for the Retiree plan, 15 basis points for the Mature plan, 12 basis points for the Average and Young plans

19 S Yield Curve Inversion Means A Recession Could Hit In

1

The Yield Curve Is Steepening Here S What That Means For Markets Seeking Alpha

The Rise Of The Yield Curve Manulife Investment Management

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Using The Yield Spread To Forecast Recessions And Recoveries Firsttuesday Journal

Why Are Yields On The Rise And How Could Higher Yields Affect Investors Rbc Wealth Management

21 Fixed Income Outlook Calmer Waters Charles Schwab

Us Recession Watch January 21 Slowing Growth Evident As Calendar Turns

The Treasury Yield Stress Point Are Interest Rates Going To Rise Seeking Alpha

Yield Curve Pioneer Harvey Says Inflation Is A Growing Threat Quartz

Goldman Goes All In For Steeper U S Yield Curves As 21 Theme Bloomberg

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

Understanding Treasury Yield And Interest Rates

Yield Curve Economics Britannica

The Bond Market Gets Optimistic Axios

10 Year Yield Rises Above 1 Ways To Play The Bond Move

1

Us Long Term Interest Rates Hit Highest In A Year On Stimulus Impact Financial Times

Yield Curve Slope Correlations Seeking Alpha

U S Treasury Yields Drop Makes Way For Slow Grind Back In 21 Reuters

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

What The Yield Curve Is Actually Telling Investors Seeking Alpha

The Rise Of The Yield Curve Manulife Investment Management

Search Results For Yield Curve Isabelnet

1

Interest Rates How Might They Look Based On Where We Re At Today Benefitspro

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

Stocks Rise And Bond Yields March Higher As Investors Focus On Economic Recovery Instead Of Trump Turmoil And Covid Crisis Currency News Financial And Business News Markets Insider

U S Treasury Yields Drop Makes Way For Slow Grind Back In 21 Reuters

Federal Reserve Bank Of San Francisco Economic Research Research Treasury Yield Premiums 2 Year Treasury Yield 10 Year Treasury Yield

Long Bond Pain Resumes Steepening U S Treasury Yield Curve

U S Treasuries Sold Off With Rising Breakeven Inflation In January Seeking Alpha

Inverse Psychology America S Yield Curve Is No Longer Inverted United States The Economist

Us Yield Curve Steepest Since 15 On Stimulus Hopes Financial Times

The Rise Of The Yield Curve Manulife Investment Management

5 Things Investors Need To Know About An Inverted Yield Curve Marketwatch

Fed S Yield Curve Control Isn T For Taming Long Bonds Bloomberg

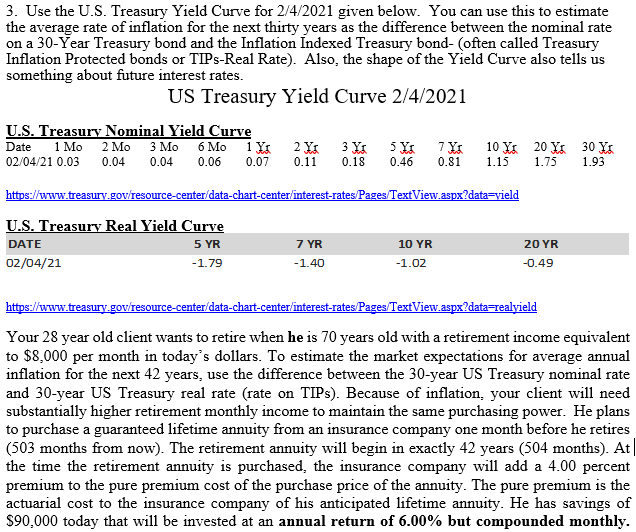

3 Use The U S Treasury Yield Curve For 2 4 21 Chegg Com

Us Recession Watch May Us Yield Curve Hides The Truth

Investment Implications Of U S Treasury Curve Steepening Wells Fargo Investment Institute

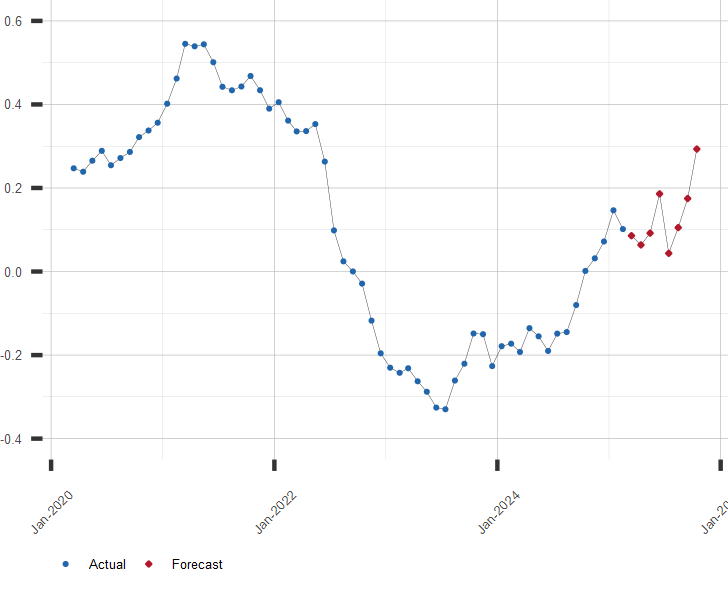

Forecast Of U S Treasury Yield Curve Slope

Higher Yields And Commodity Prices Intensify Recessions Seeking Alpha

Search Results For Yield Curve Isabelnet

What Does Inverted Yield Curve Mean Morningstar

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

V8kwijlxtng6tm

Us Yield Curve Inversion And Financial Market Signals Of Recession

Should Investors Be Concerned About Yield Curve Inversion Marquette Associates

V8kwijlxtng6tm

Goldman Sachs S Big Bond Call Is Just Bluster Again

U S Treasury Yields Drop Makes Way For Slow Grind Back In 21 Reuters

How To Play A Steeper Yield Curve Kiplinger

The Daily Yield Curve

Will 1 10 Year Treasury Yield Force The Fed Into Curve Control Bloomberg

Treasury Yield Curve Steepens To 4 Year High As Investors Bet On Growth Rebound S P Global Market Intelligence

Key Yield Curve Inverts As 2 Year Yield Tops 10 Year

U S Treasury Yields Drop Makes Way For Slow Grind Back In 21 Reuters

Steepening Yield Curves In March Looking Beyond The Covid 19 Crisis Ftse Russell

Us Recession Watch June The Deceitful Us Yield Curve

Outlook 21 Allianz Global Investors

Us Recession Watch May Us Yield Curve Hides The Truth

21 Fixed Income Outlook Calmer Waters Charles Schwab

Yield Curve Gurufocus Com

Into The Storm Us Treasury Yield Curve Slope Hits 127 As Bitcoin Hits 51 000 9 72x Since March 18 And Lumber Futures Rise 3x Since Same Date Confounded Interest Anthony B Sanders

Us Long Term Interest Rates Hit Highest In A Year On Stimulus Impact Financial Times

U S Treasury Securities Yield Curve Mar Jan 21 Download Scientific Diagram

10 Year Treasury Constant Maturity Minus 2 Year Treasury Constant Maturity T10y2y Fred St Louis Fed

/inverted-yield-curve-56a9a7545f9b58b7d0fdb37e.jpg)

Inverted Yield Curve Definition Predicts A Recession

This Metric Suggests There S An Economic Boom Ahead And Possibly Inflation

U S Yield Curve 21 Statista

19 S Yield Curve Inversion Means A Recession Could Hit In

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

Investment News December Trustmoore Group

Steeper U S Yield Curve Helps Usd But Has Not Yet Hurt Risk Demand Investing Com

Yield Curve Control What It Is And Implications Daytrading Com

Yield Curve Don T Lie Industry News Pensford

Bond Market Outlook Yields Likely To Stay Low In 21 Bonds Us News

Us Bonds Fed S Yield Curve Control Isn T For Taming Long Bonds The Economic Times

Is The U S Yield Curve Inversion Locked In Recessionalert

コメント

コメントを投稿